Customs & Duties

OMG I had no idea what I was getting into when I ordered some (admittedly expensive) shoes from abroad. I had heard that I would be responsible for customs and duties, but I honestly didn’t give it much thought when I hit the “place order” button. Let me just tell you, I have learned my lesson, and I also love my new shoes.

First off, there is a 15% GST on all goods here. If you buy something domestically, it is built into the price you see on a price tag. There’s no fancy math required to figure out exactly what the cost + 8.025% will be like there was in Austin. I like this part of it. Silly me thought I would ONLY be paying the additional 15% on the cost of the shoes. Nope. That’s not what happened.

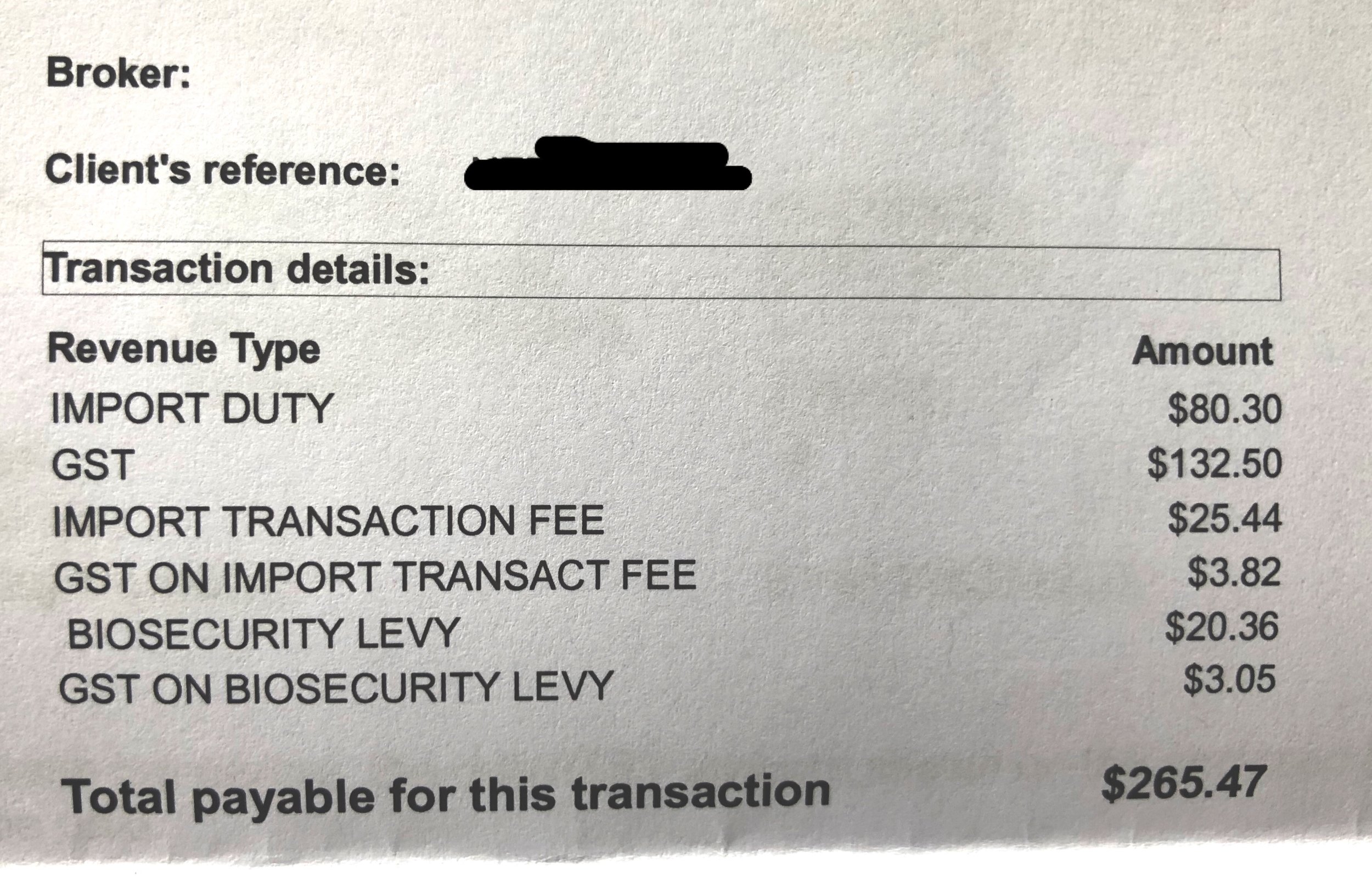

I paid an import duty (which is usually 5-10% on clothing and footwear!) GST, an import transaction fee, a GST on the transaction fee (wtf? A tax on a tax?) a biosecurity levy, and a GST on the biosecurity levy.

To avoid paying customs and duty fees, keep any potential GST and duties payment under NZ$60. If it is under that amount, you won’t get charged and your goods will arrive faster. I should’ve visited this site to estimate what I would be paying ahead of time to see if it was worth it. It’s important to note that the $60 includes the normal GST plus whatever the duty is for that type of item. So for womenswear, that’s another 10%. For shoes, another 5%. Differences in exchange rates also play a role, so the weaker the Kiwi dollar, the lower the threshold will be.

Also, my shoes were held up in customs for weeks. I could see through my tracking number where they were, but they just seemed to be stuck. I should’ve received either an email or letter with an invoice number so I could pay my fees either online, via bank transfer, by check, or at a Customs Office. Finally, I simply called the NZ Post Customer Service line that was able to track down my package with my address, give me my invoice number and payment due, and send me on my merry way. Two days after paying, my shoes finally arrived. Ironically, my letter outlining the fees arrived the afternoon after my shoes were dropped off.

Lesson learned: wait to purchase fancy goods until I’m back in the US.

UPDATE: As of December 1, 2019, there will be changes to customs and duties. Now, everything under NZ$400 will be taxed the usual 15% GST. However, goods under NZ$1000 won’t be charged all of the customs and duties previously taxed on all items over NZ$400. The short of it: purchases under NZ$400 will be more expensive, but purchases between NZ$400 and NZ$1000 will be less expensive. What do you think of this change?