House Hunting

** If you are interested in house hunting as a renter, please check out this post. The information below is for house buying.**

As many of you know, we’ve entered the New Zealand real estate market and have found a wonderful home in Auckland! Like any home purchase, it’s been a big deal and beyond stressful. I’m going to do a series of posts about the home buying process, but I thought it made sense to start with what house hunting looks like because, like everything here, its just a little bit different. There are different priorities when looking for a house, and there are little quirks from beginning to end. We started looking well before we needed to be out of our rental because we had no idea what we were getting ourselves into, and we knew that when we were looking for a rental, we had to kiss a lot of frogs before we found our prince (metaphorically speaking). Here’s an overview of what we did and we we learned during our house hunt.

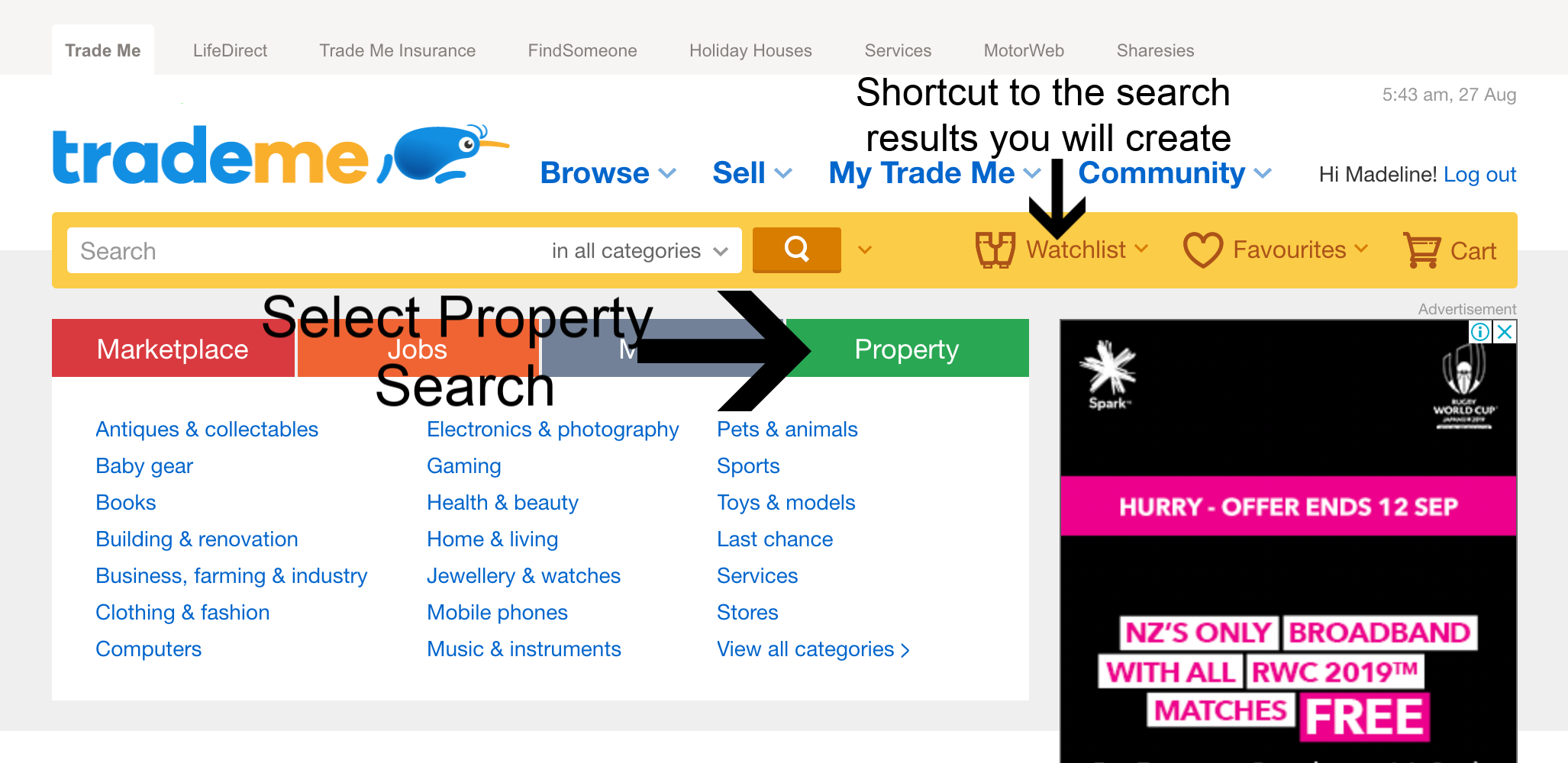

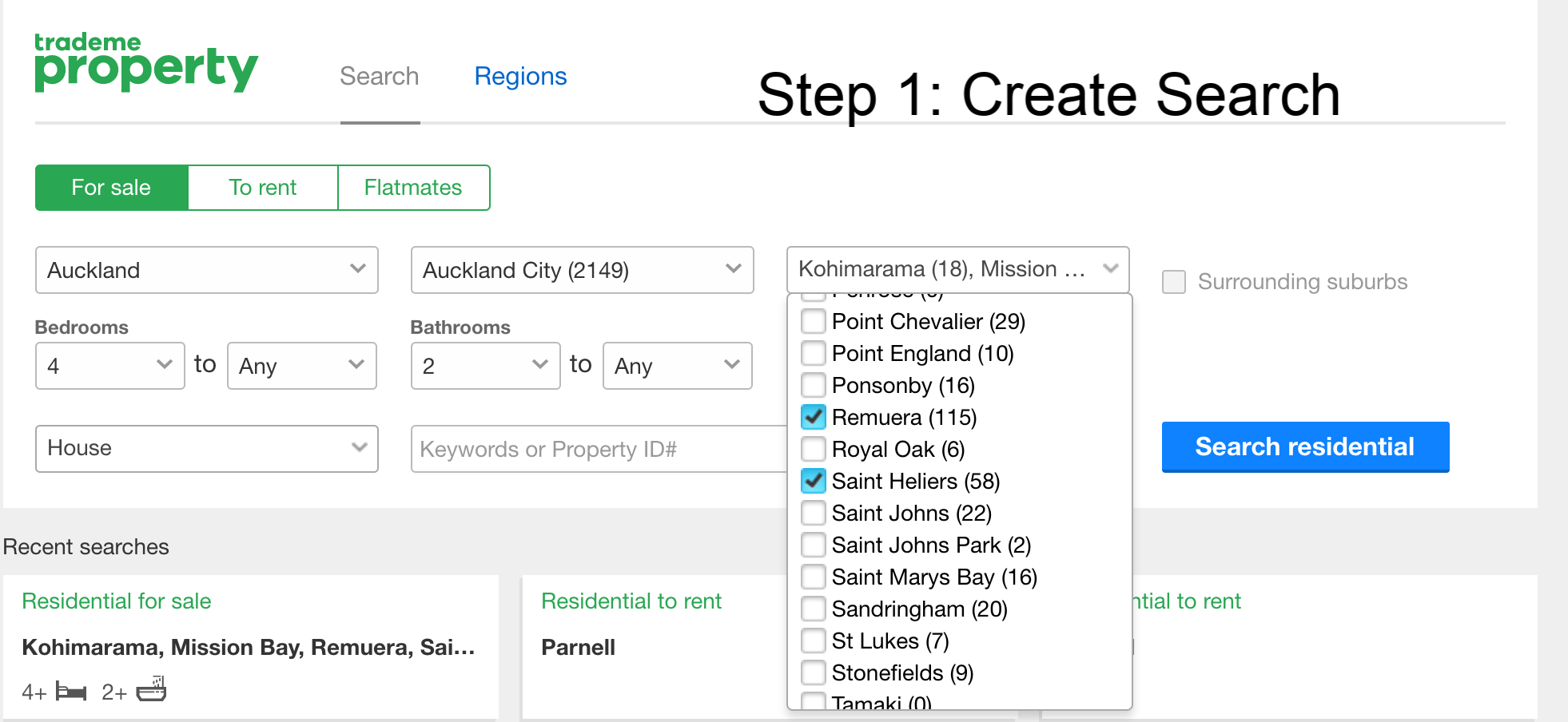

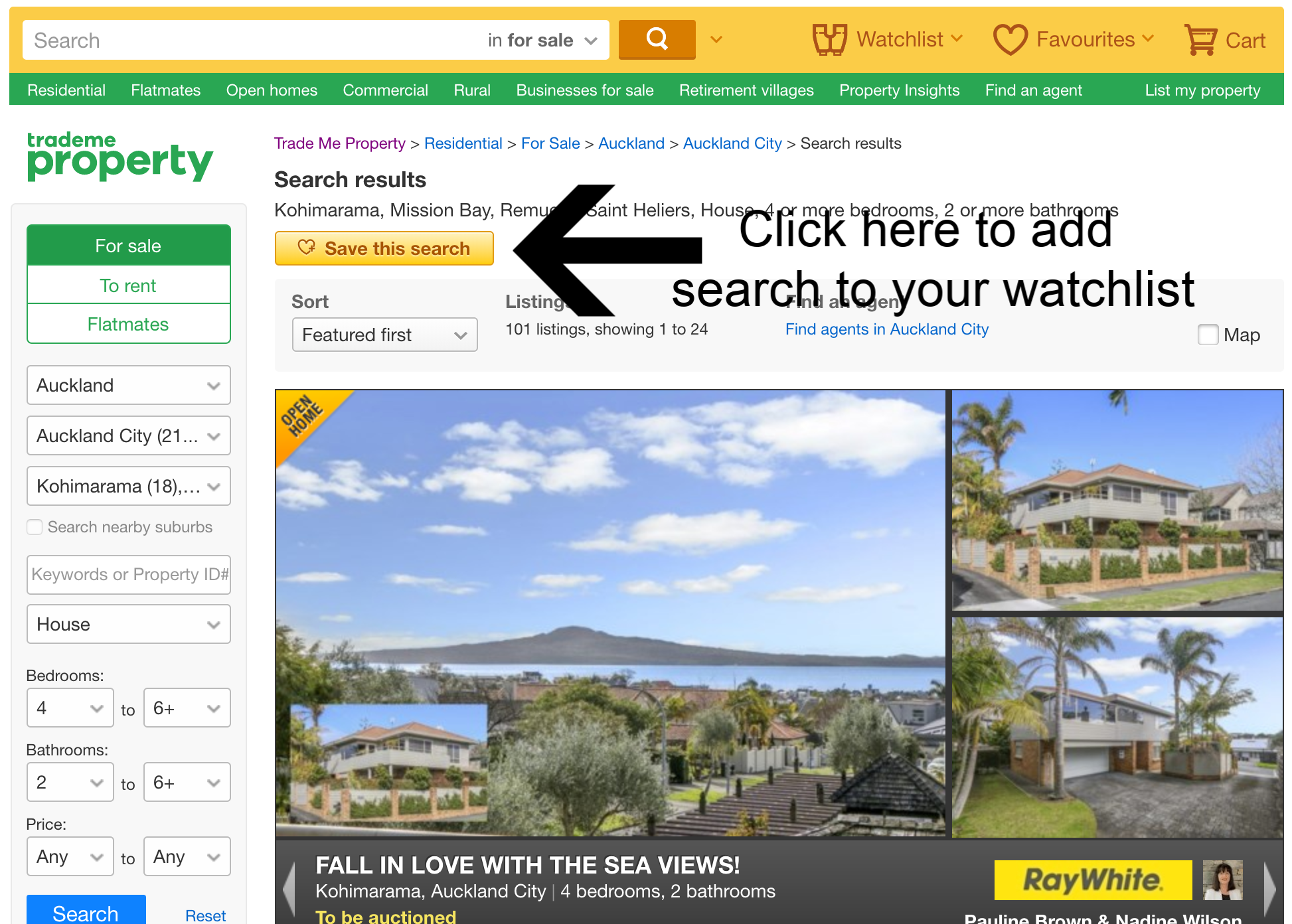

The first part of our search was the same: we decided on our target areas and budget. Then, I turned to Trademe to search for houses on the market. I have not seen buyer’s agent to help us identify houses both on and off the market like there are in the United States, though supposedly they exist. This is frustrating because I would love to be able to tell someone what I’m looking for and have them do some legwork to let me know if a house is worth visiting or not. Instead, I created several watchlists on Trademe to receive notifications when new properties that met my criteria came on the market, and we were left to view houses during the plethora of open houses or contact the selling agent to arrange a private viewing time. With two kids, it is nearly impossible to get more than one or two house viewings in on any given day, and all of the open houses are scheduled either on the weekends or occasionally in the evening on a weeknight.

At every open house the agents request contact information so they can follow up with you and add you to their mailing lists. After a few weeks of hunting, I noticed we were seeing the same agents over and over again, so I talked to them about what we were looking for in hopes that if they had something perfect not on the market yet, they would let me know. While they all said they would inform me if something came up, no one ever did. (Which in hindsight, makes sense from a seller’s agent: they want as many people looking at a property as possible to drive up the price.)

The second (and most) frustrating thing about the New Zealand purchasing process is that houses on the market often don’t have a price listed. Houses will be listed as:

To be auctioned - at a certain date and time the house will be auctioned to the highest bidder, assuming the vendor accepts the auction offer. The vendors have a reserve price that is not known to the bidders ahead of time.

Price by negotiation - In this sale method, there is no end date for offers, and potential purchasers make offers based on what they think the property is worth in the current market. Conditions can be added to the offer.

Deadline sale - A deadline sale may be advertised using the terms ‘deadline treaty’ or ‘deadline sale’. Offers are submitted, and on the deadline date - usually about 3-4 weeks after the marketing campaign starts - the vendor evaluates and hopefully chooses an offer to accept. If the property advertised includes the words ‘unless sold prior’, it means the property can be sold before the end date. Sellers can then choose to accept an offer at any time, so you need to be proactive in registering your interest. Conditions may be added to an offer.

For sale by tender - Buyers give a written offer by a specified end date. There may be less wiggle room for conditions and accepting offers early, but from what I can tell, this is very similar to a deadline sale.

Now that the housing market is starting to cool down, there are more houses listed with asking prices and fewer houses going to auction. And even fewer being SOLD at auction.

So how do you know what houses are within budget and worth looking at? There are two ways that seem to have some reliability.

First, check the property’s CV. For Auckland, you can check the council info here. I also found QV to be a useful website. This will give you a ballpark number, though some houses may sell above or below CV based on improvements made to the dwelling and market conditions. The most recent data I’ve seen from agents is that the average house in Auckland is currently selling for 5% under CV. Note that the CVs for houses can vary greatly even if they are across the street from one another, so definitely look for the actual property that you are interested in.

Second, ask the agent what the vendor’s expectations are. This is especially true for new construction properties where CVs are out of date. Vendors will usually give a vague answer like “somewhere in the high twos” or “We’ve heard anywhere from 1.2- 2 million.”

The third oddity about housing in New Zealand is that a lot of it is just weird and different. Layouts are all over the place. Older houses often have strange additions and room configurations that make no sense. Kiwi building standards are notoriously sub-par, and so it isn’t unusual to find drafty, old, single pane windows, no central heating or AC, tiny rooms, minuscule closets, and very little storage. To make matters worse, there are some insanely talented photographers running around who make houses look incredible in the marketing pictures. I’ve walked into many places and been sorely disappointed.

The fourth quirk about real estate in New Zealand is that there are four types of ownership mechanisms:

Freehold/fee simple - you own the land and the house. This is the most common type of ownership.

Leasehold - someone else owns the land, but you buy the right to posses the land and buildings for X amount of time.

Unit title ownership - common in a building development.

Cross lease - you own a share of the freehold title with other cross lease holders and a leasehold for the land that your building is on. Cross leases can be troublesome if you’ve got bad neighbours, and the price of a cross lease property is typically about 10-15% less than it would be if it was a freehold property. They can be great if you want to buy into a neighbourhood for a great price.

It’s important to know what you’re getting yourself into as you look at properties, and its not always obvious at first glance what type of property you’re looking at.

Once you’ve identified a house you like, depending on the type of sale, your actions will diverge. If you’ve got a house going to auction, it is important to get a lawyer involved and an inspection done right away, before the bidding. Typically houses are on the market and open for viewings for about three weeks prior to auction day, so you should move quickly. Once you buy at auction, there’s no way out of the contract, so you want to make sure you know exactly what you’re getting into ahead of time. To bid at auction, you have to REALLY want the house because you’ll pay quite a bit of money upfront in the form of lawyers fees and inspections with no guarantee that you’ll get the house at the end of the day. To give you an idea of the costs, we have about NZ$4000 in legal fees and NZ$800 for an inspection prior to an auction.

The good news is if you find something during your due diligence process prior to the auction, you have the option to negotiate some terms with the vendors prior to the auction. The understanding is that if you win the auction, the pre-negotiated terms will be part of your contract. This could be anything from the vendors agreeing to fix something found by an inspector, a change in the settlement date, etc. You’ll definitely want your lawyer involved to draft the conditions! Also, keep in mind that these are conditions that will only apply to you if you win the bid. If someone else wins, they may have a different set of conditions or none at all.

With the other types of sales, you can build in contingencies and an option period into your offer, which is much more in line with what we do in the United States. However, if you feel like you need to make a stronger bid, it might make sense to go ahead and get an inspection done prior to putting your offer in so there is one less condition. (Other conditions might be getting a good house valuation, subject to financing, or selling your own house.) Again, getting a lawyer involved to help craft a sound offer is a good idea as the agent will be representing the seller, not you. If a house doesn’t sell at auction, it will usually change to price by negotiation, so if you’re on the fence about a house, it may be worth waiting to see what happens at auction. If the house doesn’t sell, you may have an opportunity to buy it later on - with conditions on your offer. This of course, means you may risk loosing out at the auction.

House hunting feels like a national sport in New Zealand. Real estate is a booming industry here, and people take it seriously. There are hopes that the changes in foreign buying rules will cool the market some, and that seems to be happening to a small extent. If you’re in a position to buy, now is a good time to look.

Side note: buying a house isn’t an option for everyone in New Zealand. In 2018, new regulations went into place limiting which foreigners could purchase housing. There is a very good guide covering who can buy here.